Editor's note: The whole world is famous achieve cast research organization CBInsight to issued research brief report recently, surpass company of science and technology of newly established of 1100 United States through research from the development route after taking seminal period to invest, discovery is become among them alone the enterprise of horny animal is about 1% .

The basis is textual, compile as follows:

Funnel of venture capital investment (complier notes: Show as financing wheel goes forward one by one, less and less newly established company can obtain fund) showed, a kind of inherent nature in process of venture capital investment chooses.

Well-known, most poineering company failed. But from the point of data, we can see the merit in the number, capital lifecycle loses energy know newly established company better in what.

We dogged companies of a batch of many 1100 newly established, see them from raise money since investment of brushstroke seed, whats to produce, gain what experience.

So, as the person that do poineering work, once you obtain fund of the first batch of seeds, what can you expect? The following data confirmed traditional point of view: The poineering company of nearly 67 % is in the backwater of a certain phase in process of venture capital investment not before, fail to exit or raise follow-up fund.

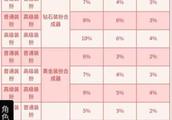

In our newest research, we were tracked more than 1, 100 are in 2008 -2010 year in the United States the company of science and technology of seminal annulus. Be less than a half, namely 48 % , tried to raise money the 2nd round capital. Every advance one round, get new capital infuse, steadily forward company the metropolis is again a few less. Only the company of 15 % continues to raise money four-wheel capital, this normally with photograph of C annulus financing is corresponding.

Read the following data, can in more detail knows research outcome --

What did we discover?Newest data shows sequel annulus can be entered after the first round of financing second the company raises to 48% from 46 % .

The seed that has 30 % annulus the company is passed make public collect first or buy exit, this increases 2 percent than last year.

The company final or of 67 % died, or ego is maintained (this may be very good to the company, but not be so good however to investor) . Since we analyse this respect data last, this number declined 3 percent. Know the particular case of these companies very hard, because capital announcement often gets a large number of conduct propaganda, and cash flows or the expression of gain ability is done not have however. In addition, a few companies are in formal " death " before, can have very long period of time " corpse company " condition, the death of besides company also is done not have " death proves " such thing.

As expected, in our new analysis, become alone the possibility of horny animal is very small still, wander in 1 % to control (1.07 % ) , 12 companies achieved this one status. Company of wh some of which is come to company of the most welcome science and technology 10 years, include Uber, airbnb, slack, stripe and Docker.

13 companies exit more than 500 million dollar, include Instagram among them, the lead company in the category such as Zendesk and Twilio.

It is easier that B annulus financing compares A annulus. Although almost half (48 % ) the company can enter A annulus financing, but the company that has 63% enters B annulus smoothly.

The time between each rounds of financing is about the same, control in 20 months about. The 6th round case, financing time shortened 5 months. Investigate its reason is, to these annulus second the company is to grow the person above average of the company of later period. This data also shows, investor longs to enter more on this one node.

The seed from all exposure period trade dimensions reachs median is 350 thousand dollar, and average is 670 thousand dollar, median and average the difference between often increases round of take second place as the elapse of time, those who make clear later period is super annulus second counterbalance is worth uptilt. In the 6th round of sequel annulus second in, median amount is 4, 0 dollar, but it is 120 million dollar on average.

Research techniqueThis research includes a group of headquarters to be set in company of science and technology, these companies are in 2008, 2009 or raised money the first round 2010 seminal capital, research observes they arrive all the time on August 31, 2018. In view of time limits big, these companies have enough time to undertake financing perhaps is exited falling one round.

Trade not plan enter sequel annulus second, have equity only investment plan is sequel annulus second.

Notable is, 2008-2010 year seminal annulus trades to be inferior to on the whole so outstanding now. As small the outbreak of venture capital investment, and much phase fund is in seminal annulus trades frequency rises, in going a few years seminal annulus financing is increasing. If we duplicate this one research after a few years, so these numbers may look very can different, possibly even only lesser proportional company obtains A annulus and B annulus capital.

Complier notes: CBInsight undertook to companies of these science and technology long-term data is tracked, can undertake the summary of level sex and trend are analysed. Can read further with two analysises March 2017 in December 2015.